Content

Because the estimated cost of ending inventory is based on current prices, this method approximates FIFO at LCM. Reported in a prior year, unlike international reporting standards, even if the NRV for inventory has recovered. Subtract the amount of the doubtful-accounts allowance from the total accounts receivable. The result is the net realizable value of accounts receivable.

Is IAS 2 still applicable?

The IAS 2 is applicable to all the inventories, excepting for construction contracts including contracts that are in progress and also includes directly related service contracts and financial instruments. … However, the actions that should be implemented are not mentioned in these inventories.

Inventories, in general, cannot be revalued upward once written down. Net realizable value is the cash amount that a company expects to receive. Hence, net realizable value is sometimes referred to as cash realizable value. An asset deal occurs when a buyer is interested in purchasing the operating assets of a business instead of stock shares. In terms of legalese, an asset deal is any transfer of a business that is not in the form of a share acquisition.

An Example Of A Footnote On Obsolete Inventory

Examples of variable costs are staff wages, direct materials and production supplies. Fluctuations in production costs will affect the net realizable value.

When you’re planning a move to a new city, there are a lot of things to research in advance. You’ll need to be in the know regarding crime rates, average home prices, the cost …

Net realizable value;NRV正味実現可能価額

Bad debt expenses 貸倒損出

Allowance for doubtful accounts 貸倒引当金

↑のdoubtful accountsって直接的な表現すぎて笑える😁— Sinatra 勉強垢@USCPA挑戦中 (@comeflywithme00) November 27, 2021

It usually requires certified public accountants to do the job as it involves a lot of judgment on their part. The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase. Each individual’s unique needs should be considered when deciding on chosen products. When accountants face uncertainties in potential profits or gains, they should not be recorded but uncertainties on expenses and losses must always be recorded.

Relevance And Uses Of Net Realizable Value Formula

The Generally Accepted Accounting Principles and International Financial Reporting Standards use the NRV method in inventory accounting. Now let’s say after 2 years, the demand for that machine decline because of which the expected market price also decreases and now it has dropped to $4100 but the cost is the same at $4000. Subtract all the cost from the selling price to come at the net realizable value.

- Add up the NRV for all items, and the result is the total net realizable value for the company’s inventory.

- The dealership has to insure the car and make sure it has proper license plates.

- So during inventory valuation, NRV is the price cap for the asset if we use a market method of accounting.

- The cost of the joint process allocated is $640 for cake A and $1,360 for cake B.

- Businesses typically list the net realizable value of their inventory and accounts receivable on their balance sheets.

- GAAP are the guidelines for financial reporting and recording, and they’re established by the Financial Accounting Standards Board.

Therefore, it is expected sales price less selling costs (e.g. repair and disposal costs). NRV prevents overstating or understating of an assets value. NRV is the price cap when using the Lower of Cost or Market Rule. Costs of selling could be various things, but basically they are costs the company must incur in order to be able to get the inventory sold.

Products

For businesses that hold inventory for long periods of time, these inventories will become obsolete, have a lower market value, or deteriorate over time. When it comes to estimating the ending value of an inventory or accounts receivable, what accountants use for a conservative estimate or valuation method is to compute for the Net Realizable Value . The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits.

Net Realizable Value (NRV) Definition – Investopedia

Net Realizable Value (NRV) Definition.

Posted: Sun, 26 Mar 2017 00:38:27 GMT [source]

Now X has a number of machines which it uses to produce the items. One of those machine X wants to sell since it is not much use. Company X is expecting that if they sell that machine today, they will get $5000 for that. But they have to go through a middle man which will charge $100 as it cost. Also, the company has to bear all the paperwork and transportation cost which is another $200.

Definition Of ’net Realizable Value’

Determine the Market Value or expected selling price of the asset. Under GAAP, it is expected for the accountants to apply a conservative approach in accounting – make sure that the profits and assets of the company are not valued more than they should. For accounts receivable, the amount a company can realize from debts owed by customers depends on the company’s history of collection. Some industries are more volatile than others and have a higher percentage of default. Also, businesses that utilize more creative means of debt collection may see a positive difference in the NRV at the end of the year. Further, writing down inventory prevents a business from carrying forward any losses for recognition in a future period.

Applying this principle allows stakeholders of the company to feel assured that the financial statements of the company are not overstated and misleading. In accounting for Accounts Receivable, accountants always make an estimate for any allowances that would make some outstanding invoices to be uncollectible called the Allowance for Bad Debts. Now let see a more detailed example to see how we report inventory using net realizable value formula. Subtract the allowance for doubtful accounts from the total of all accounts-owed to arrive at the NRV.

For example if product can be sold individually and its selling price and related costs and can be determined independently then for this product LCNRV rule will be applied on individual basis. If product is of such nature that its NRV cannot be determined on individual basis as it has to be sold with other products as a package then rule will be applied on group basis.

Adjusting Inventory Value

A set of online digital assets or virtual value that may be left to another person in a will. Prepaid expenses — these would be assumed as if realized into cash. For example, if there is insurance that has been prepaid for the year, the amount left for the year would be its cash value. The cost of homeownership in the US is often the main concern of first time home buyers. Is it better to postpone the purchase of a home or the … There’s been a lot of demand for QR codes for real estate signs as they became a fabulous way to go beyond the advertising nature of the traditional static “for sale” …

Most businesses accomplish this by multiplying the total value of their accounts receivable by an estimation of the percentage of accounts that will be uncollectible. This estimation is based on the average percentage of delinquent accounts present during previous accounting periods. In accounting, NRV is an acronym that stands for “net realizable value.” An asset’s net realizable value is the amount of money a business expects to receive when it sells or collects on the asset. Most businesses use net realizable value calculations to estimate the worth of their current inventory or accounts receivable. The very essence of cost accounting is to determine the actual costs of products in order to arrive at its sales price. The LCM method states that the cost of inventory must be recorded at the original cost or market price, whichever is lower. Economic conditions can influence NRV at the end of the year for both accounts receivable and inventory.

Eventually, the company will have to “replenish” the allowance. When it does so, it reports an expense for the amount added to the allowance. Determine how much money you will have to spend to get the items ready for sale and to actually sell them. For a shoe retailer, this could mean the cost of sales commissions, packaging or anything else required to get the shoes out the door. Find all the attributable costs of selling the asset like transportation cost, production cost, and advertising, etc.

Add the split-off, or separable, costs of each pastry to the allocation total. To arrive at the cost per unit, divide each total cost amount by the number of units produced.

Under normal circumstances, cost of inventory is always lesser than the net amount business can earn by selling the inventory, called net realizable value . Common sense dictates that cost has to be lesser than NRV to make profit. But following a concept of conservatism, even if NRV is higher than cost, value of inventory is kept at cost and gain is not recognized until the inventory actually sells. Valuing on hand inventory is not as easy as some may think.

This also involves some judgments as the current selling price from one company to another is difference. However, in some jurisdictions it is preferred that instead of altering inventory account, loss is recorded in separate contra-asset account. Businesses typically list the net realizable value of their inventory and accounts receivable on their balance sheets. High net realizable values raise the value of a company’s total assets, which it uses to attract potential investors.

Type the word that you look for in the search box above. The results will include words and phrases from the general dictionary as well as entries from the collaborative one. A set of collection of one’s internet assets or value gathered in order to assist transfer of online rights. A set of virtual assets or value in cyberspace left behind after one’s death fall on legal successors as right.

Importance Of Nrv

These account titles are synonyms; the two account titles mean exactly the same thing. If my customers owe me $40,000, but I believe $1000 will never be collected, I subtract 1000 from 40,000 to get $39,000. If I am planning to spend some money, I would only count on spending $39,000 because that is the amount of money I believe I will actually receive. Under this method once the loss is determined, cost of goods sold account is debited and inventory account is credited to record the write-down loss on inventory.

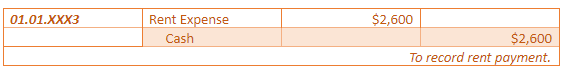

Gross receivables less allowance for doubtful accounts, representing the expected collectibility of those receivables. Inventory a/c2088Recovery of NRV loss a/c2088Recovery of NRV loss a/c will be later closed in profit and loss. Give the journal entry to record the recovery of write-down loss.

SEMILEDS CORP Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K) – marketscreener.com

SEMILEDS CORP Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K).

Posted: Mon, 29 Nov 2021 13:28:04 GMT [source]

It does not make sense to report an asset at any value higher than the amount it can recover and may overstate the assets materially. Therefore, entity must switch to NRV basis from historical cost basis of measurement if recoverable amount falls below cost of asset. When determining the market price for LCM, there are certain restrictions that apply. The market price can’t be higher than the market ceiling nor lower than the market floor. The market floor is the NRV minus the normal profit that is expected to be received from the sale of the inventory item. So, if the market price of an item falls between these two figures, then it is deemed an acceptable price.

With newer products in the market offered at competitive rates, entity is unable to make sales or at least at profitable rate. Net realizable value is a commonly used in the field of inventory accounting. It is used in GAAP accounting rules to ensure that the value of an asset or investment is not overstated. Net realizable value is the measurement of an asset’s value when the asset is prepared for sale. Net realizable value is the amount of cash, or its equivalent, expected to be derived from the sale of an asset minus the costs incurred as a result of the sale. These costs include the costs to complete the item and the costs of the sale. So under the old rule of LCM, replacement cost would be the ceiling.

Credit aspect is however, recorded in contra-asset account with appropriate name e.g. Under this method instead of debiting the loss to cost of goods sold, a separate account with appropriate name is debited and then closed in profit and loss.

Author: Mark Kennedy